Select your age

Winter 2021

I keep an eye on the funding ratio

Regardless of whether you’re currently employed by NN or you've left the company or retired, the pension fund's funding ratio has an impact on your pension. That's why it’s an important indicator to keep an eye on. This article gives you an update on the development of the funding ratio in the third quarter.

The pension fund's funding ratio is a measure of its financial position. If the funding ratio is 100%, the pension fund has exactly enough cash to pay out its pension commitments. The higher the funding ratio, the better the pension fund’s financial position.

Impact of interest rates

The funding ratio is the ratio between the pension fund’s assets (investments) and its commitments. In addition to return on the pension fund’s investments, interest rates have an impact on the fund's performance as well. When interest rates decline, the funding ratio declines too. When interest rates rise, the funding ratio grows and the pension fund's financial position improves.

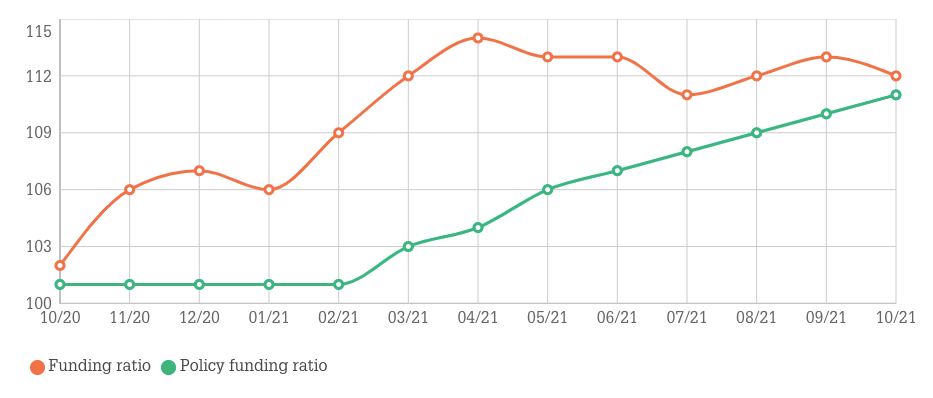

Development of the funding ratio

NN CDC Pensioenfonds’ funding ratio showed a slight upward trend in the third quarter, due to stock market fluctuations and low interest rates. This was also reflected in the pension fund's policy funding ratio, which is equivalent to its average funding ratio for the preceding 12 months. Based on the fund's policy funding ratio as at 30 September, the pension fund will decide whether your pension can be increased to keep up with inflation (indexation). As at that date, the fund will also determine whether it will be able to fund the pension accrual targeted for the year ahead. In this edition of our Special, you will read how much indexation and pension accrual you can expect to receive.

In the period July through October 2021, the funding ratio stayed almost unchanged despite high levels of volatility in the financial markets. Share prices rose while long-term interest rates declined, on balance, during this period. Long-term interest rates initially declined amid concerns about a new wave of Covid-19 infections, but recovered partly as central banks in developed countries (following the American central bank) announced a tightening of their monetary policy in response to expectations of rising inflation. The inflation spike is mainly the result of disrupted supply chains, surging energy prices and growing tightness of the labour market (particularly in the USA).

What you can do

If you want to stay up-to-date on the financial situation of NN CDC Pensioenfonds and the implications for your pension, check the website for news and quarterly updates on funding ratios, investment results and developments in the financial markets.